Employees’ State Insurance Corporation (ESIC) provides various services to both employers and employees through its information portal and service portal. Both employers and employees need to contribute to the Employee’s State Insurance. This contribution can be made online through the official website. This article covers all the important aspects of ESIC Challan Online Payment.

You will get all the essential details of ESIC challan online payment 2025 through this article like its objective, benefits, features, eligibility, login, e challan payment, print receipt, etc. So if you are an employer or an employee who wants to contribute to the employee’s State Insurance then you have to go through this article to get complete details regarding payment of e challan under ESIC online payments.

About ESIC Challan Online Payment 2025

The Employee’s State Insurance Corporation has enabled its members to pay challan online. Employees State Insurance Corporation is basically an autonomous corporation that manages the employee’s State Insurance which is a health insurance and social security scheme for workers of India. Both employers and employees are required to make ESIC online payments (payment of challan). The rate of contribution by the employer is 4.75% of the wages payable to the employees and the contribution of employees is 1.75% of the wages payable.

All those employees who are earning less than Rs 137 a day as a daily wage are exempted from payment of their contribution. ESIC challan online payment is enabled for account holders that have a net banking facility. To make this payment citizens are not required to visit any government offices. This will save a lot of time and effort. Beneficiaries are required to make ESIC online payments before the 15th day of every month.

Also Read: How to Register in the National Scholarship Portal (NSP)?

Objective Of ESIC Challan Online Payment

The main objective of ESIC online payment is to provide the facility of payment of challan online. Now citizens are not required to visit any government offices to pay their challan as the employee’s State Insurance Corporation has made the facility available online. This will save a lot of time and effort and will also bring transparency to the system. To pay the challan, online citizens are required to have a net banking facility. Both employers and employees are required to make employees State Insurance corporation payments. Now both employers and employees can pay their challan from the comfort of their homes.

Key Highlights Of ESIC Online Payment 2025

| Name Of The Scheme | ESIC Challan Online Payment 2025 |

| Launched By | Government Of India |

| Beneficiary | Citizens Of India |

| Objective | To Provide Facility Of Payment Of Challan Online |

| Official Website | https://esic.in https://esic.nic.in |

| Year | 2025 |

| Mode Of Payment | Online |

Benefits And Features Of ESIC Challan Online Payment 2025

- The Employee State Insurance Corporation has enabled its members to pay challan online

- State Insurance Corporation is an autonomous corporation that manages the employee State Insurance

- Employees State Insurance is a health insurance and social security scheme for the workers of India

- Both employers and employees are required to make ESIC online payment

- The rate of contribution by the employers is 4.75% of the wages payable to the employees and the contribution of the employer is 1.75% of the wages payable

- All those employees who are earning less than Rs 137 a day as a daily wage are exempted from the payment of their contribution

- ESIC online payment is enabled for SBI account holders that have a net banking facility

- Now citizens are not required to visit any government offices in order to make payment of challan

- This will save a lot of time and effort and will also bring transparency to the system

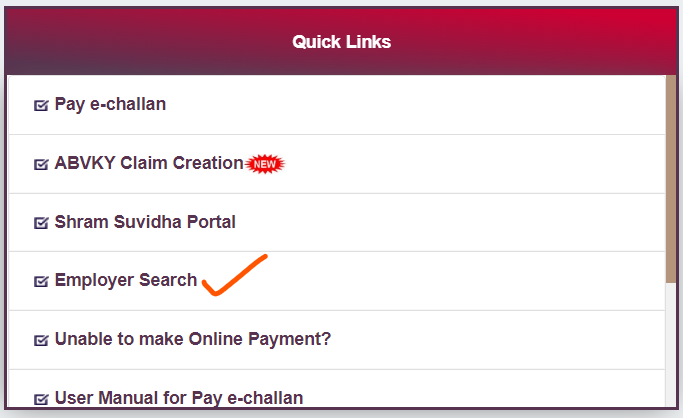

Procedure To Make ESIC e-Challan Payment Online

There are two official websites for ESIC Online Payment through which you can pay e-challan. Here we are showing process from the old website (https://esic.in). You can also do the same from the new NIC website (https://esic.nic.in)

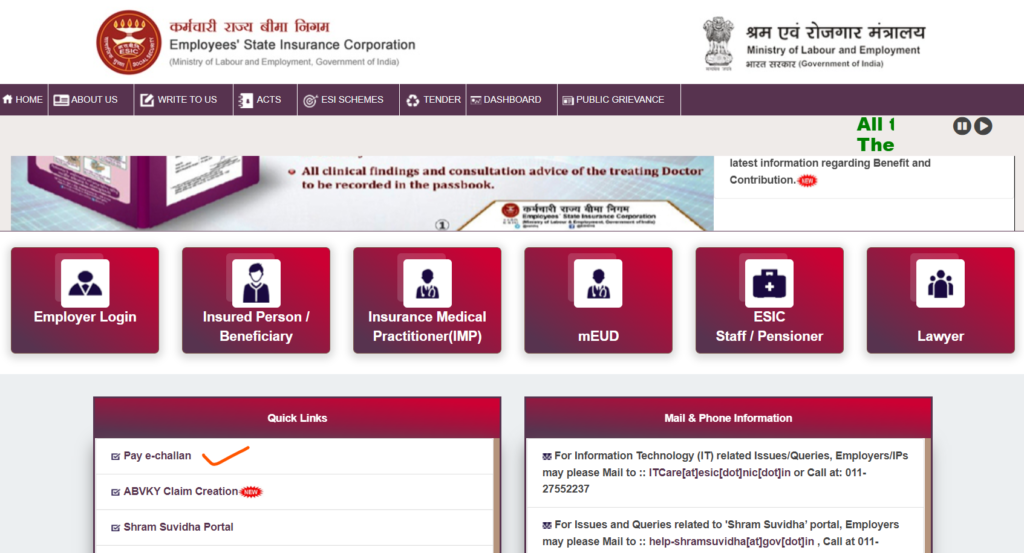

- First of all, go to the official website of Employees’ State Insurance Corporation. (https://esic.in)

- The home page will open before you.

- On the homepage, you have to click on the pay e-challan option on the Quick Links as shown above.

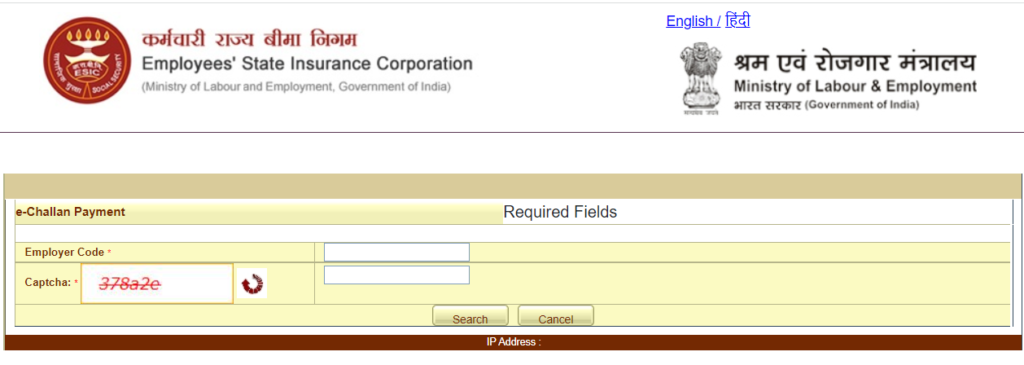

- A new page will open before you.

- On this new page, you have to enter the employer code and captcha code

- After that, you have to click on the search

- Now you have to select the challan number to continue for payment

- After that, you have to note down the challan number and click on continue

- Now you have to select your bank for payment through internet banking

- After that, you have to enter your user ID

- Now you have to enter your credentials to proceed with payment

- After that, you have to click on pay

- Payment success confirmation receipt will display on your screen

- Now the transaction is completed success message will also appear

- You have to click on print to print this receipt

- By following this procedure you can make ESIC payments online

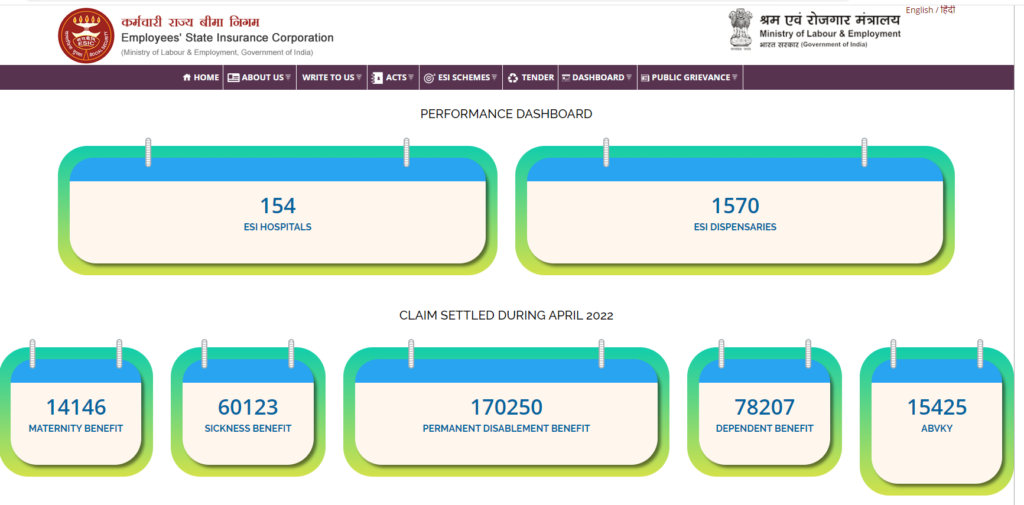

Procedure To View ESIC Dashboard

- Go to the official website of Employees’ State Insurance Corporation

- The home page will open before you

- Now you have to click on the Dashboard >> EPIC Dashboard option from the drop-down in the menu bar.

- A new page will appear before you

- On this new page, you can view the dashboard.

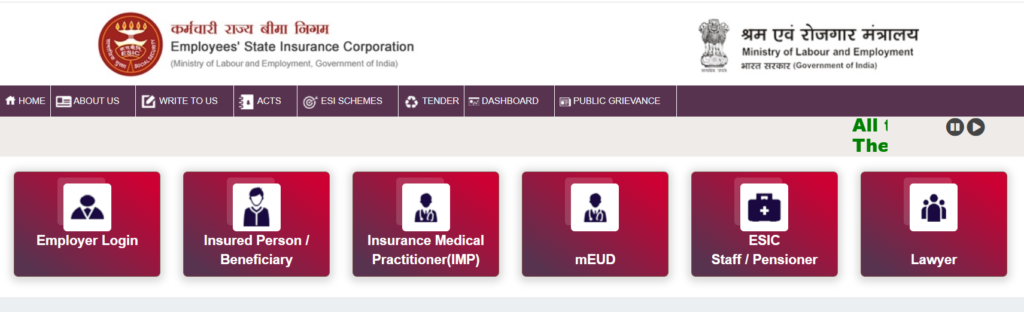

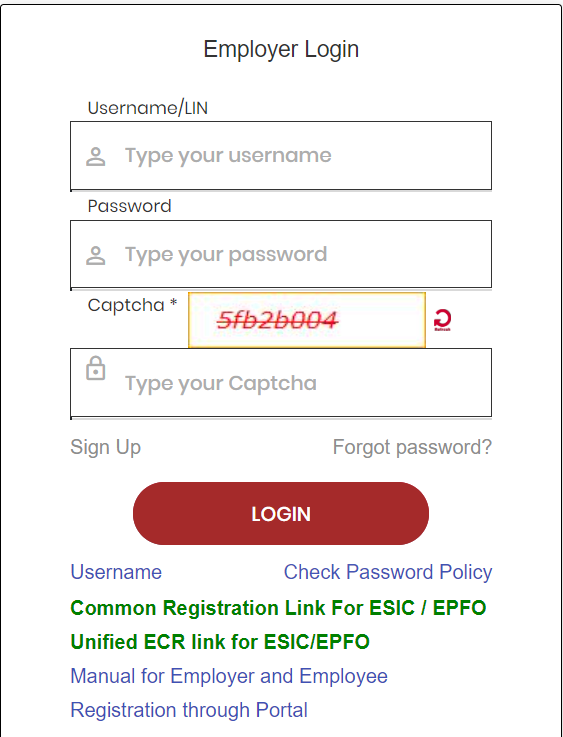

Procedure To Do Employer Login

- First of all, go to the official website of ESIC

- The home page will open before you

- On the homepage, you need to scroll down and click on Employer Login as shown on the below screen.

- A new page will appear before you

- Enter your username /LIN and password

- Enter the captcha and Login

- By following this procedure you can do an employer login

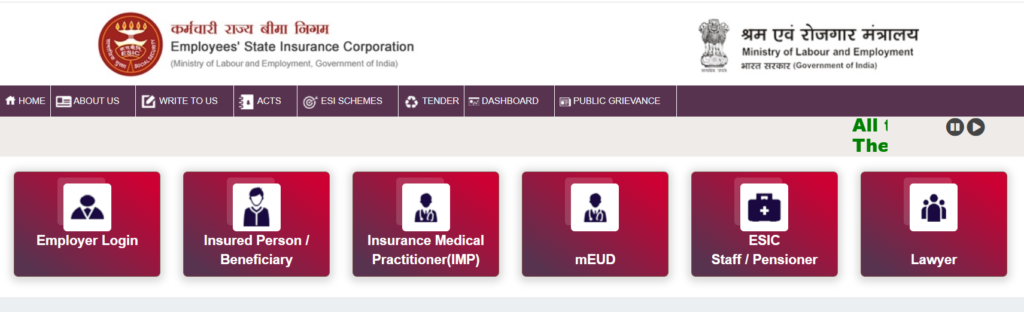

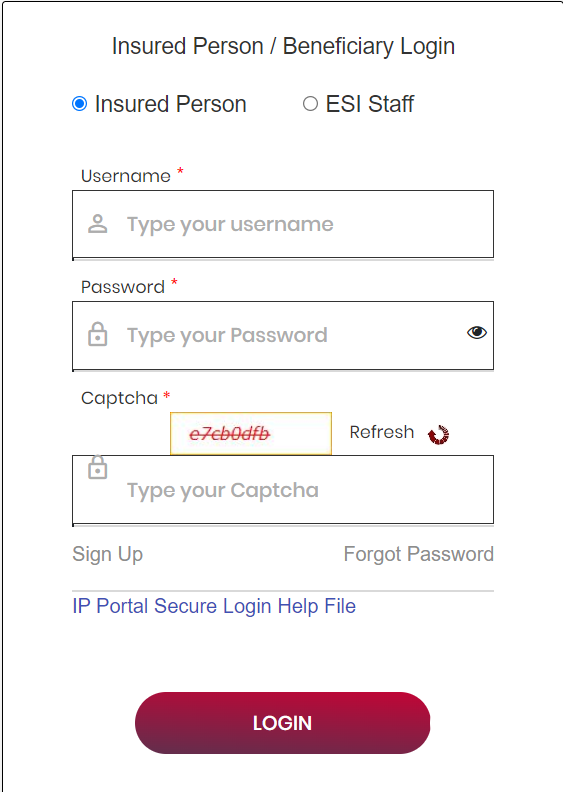

Procedure To Do Insured Person/Beneficiary Login

- Go to the official website of ESIC

- The home page will open before you

- Now you are required to click on the Insured Person/ Beneficiary option shown below.

- The login page will appear before you

- You have to enter your login credentials on this page

- Now you have to click on the login.

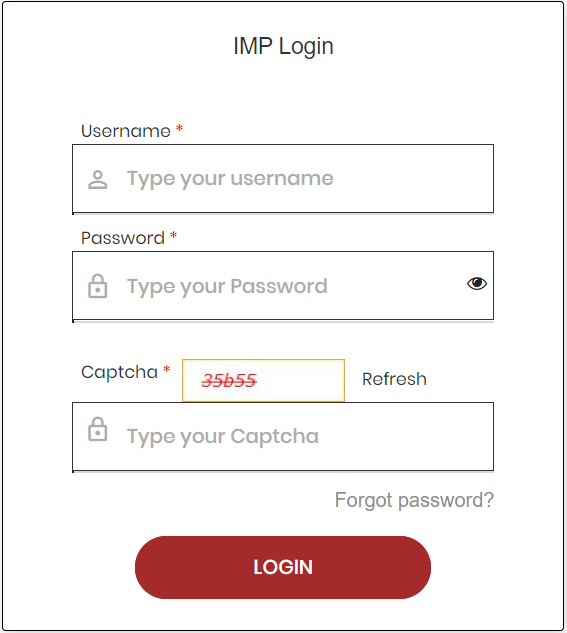

Insurance Medical Practitioner (IMP) Login

- Visit the official website of ESIC

- The home page will open before you as shown in the above steps.

- On the home page below, you are required to click on Insurance Medical Practitioner (IMP)

- Login will appear before you as shown above.

- On this page, you have to enter your username password, and the captcha code

- Now you have to click on the login

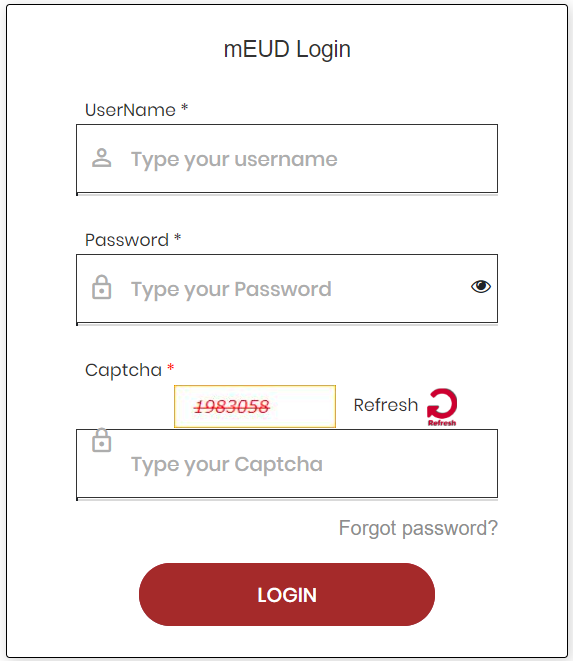

Procedure To Do mEDU Login

- First of all, go to the official website of ESIC

- The home page will open before you

- Now you are required to click on mEUD

- The login page will appear before you as shown above.

- On this page, you have to enter your username and password

- After that, you have to click on the login

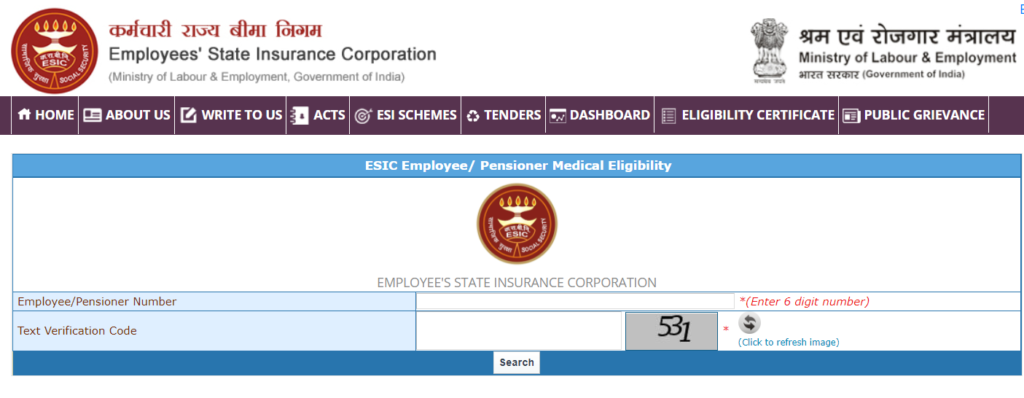

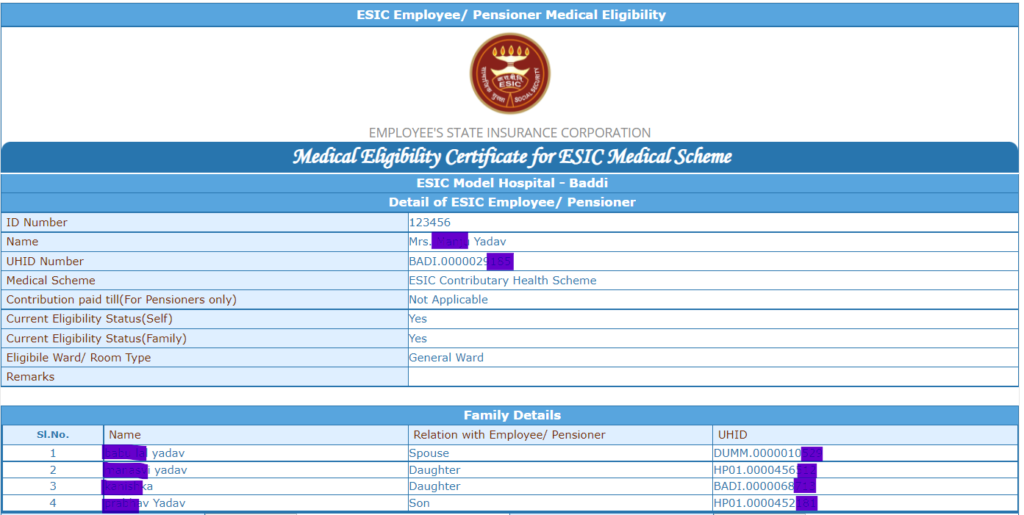

ESIC Staff/Pensioner Medical Eligibility Check

- Go to the official website of ESIC

- The home page will open before you

- On the homepage, you are required to click on ESIC Staff/Pensioner

- A new page will appear before you

- Enter Employee /Pensioner Numner (6 digit number)

- Enter the captcha and press the Search button.

- You will get the medical scheme details of self and family.

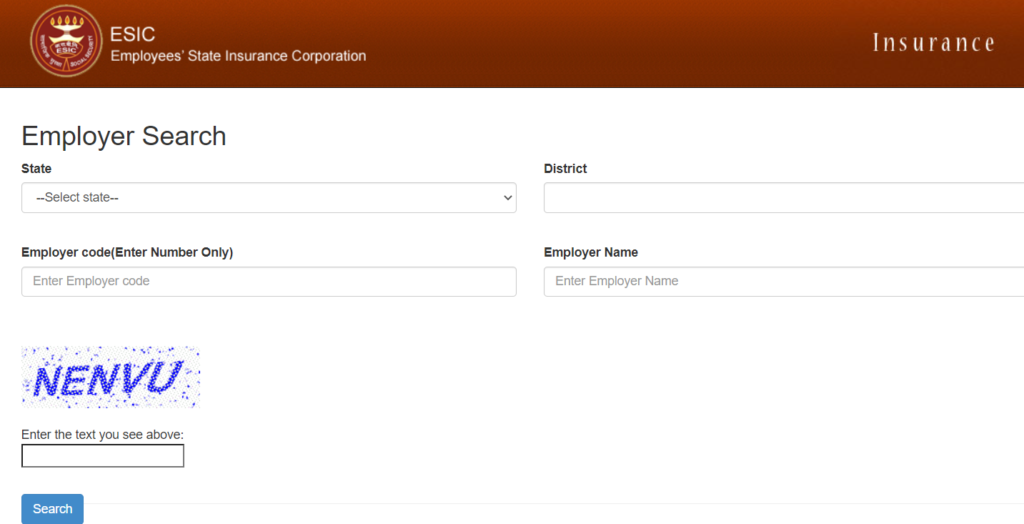

Procedure To Do Employer Search

- Go to the official website of Employees’ State Insurance Corporation

- The home page will open before you

- On the home page have to click on Employer search on Quick Links

- New Page will open

- Now you have to select your state and district

- After that, you have to enter the Employer code, Employer name and captcha code

- Now you have to click on the search

- Required information will appear before you

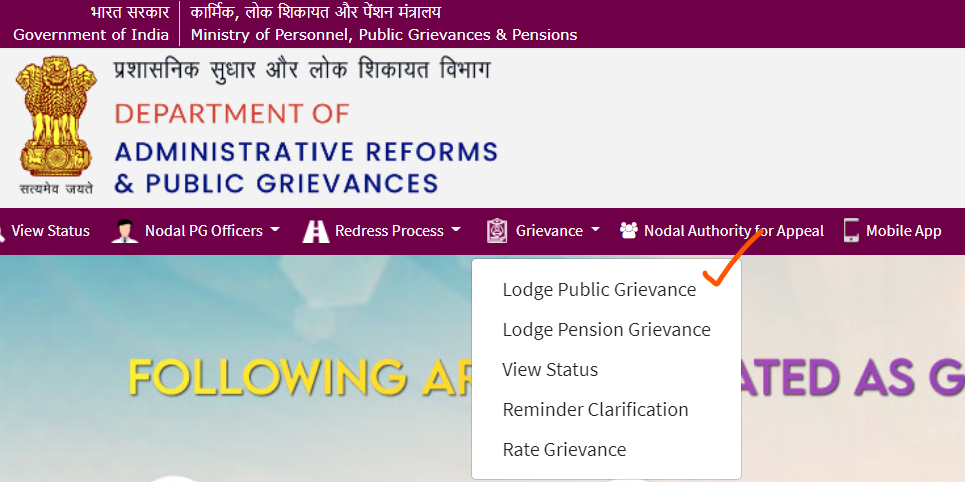

Procedure To Lodge Grievances

- First of all, go to the official website of ESIC

- The home page will open before you

- On the home page, you need to select the Public Grievance option and then select Lodge a Grievance from the drop-down menu.

- A new website (https://pgportal.gov.in) will open (Department of Administrative Reforms and Public Grievances)

- Select Grievance >> Lodge Public Grievance from the drop-down menu as shown below.

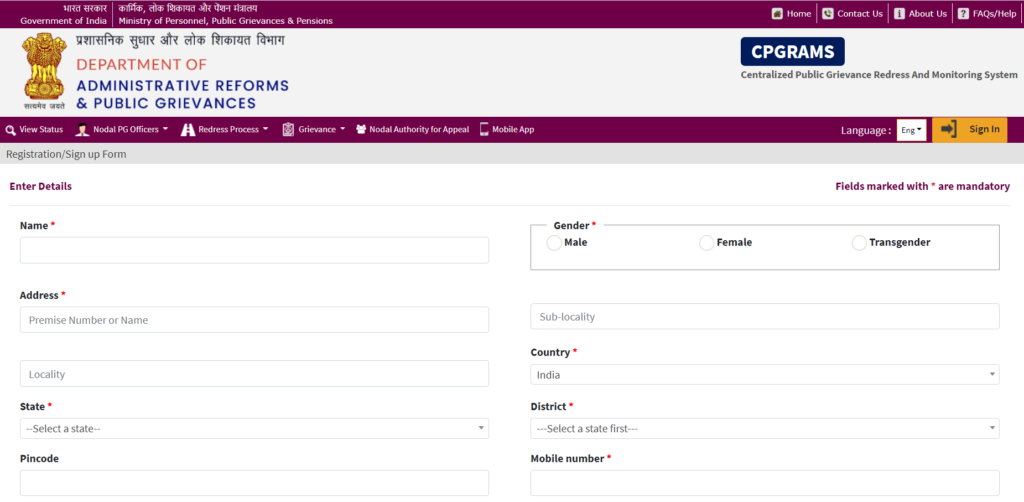

- On the Next page, you will get the message- “Grievance can now be lodged only by registered users.”

- Now you need to register to lodge a grievance. If you are already a registered user then click on User Login or to register click on Click here to register

- A registration form will appear before you as shown below.

- You have to enter your name, gender, address, country, state, pin code, district, mobile number, etc.

- Now you have to click on submit.

- After that, you have to log in by entering your username password, and captcha code

- Now you have to click on Lodge Grievance

- And fill out the grievance form

- After that, you have to click on submit

- By following this procedure you can lodge a grievance.

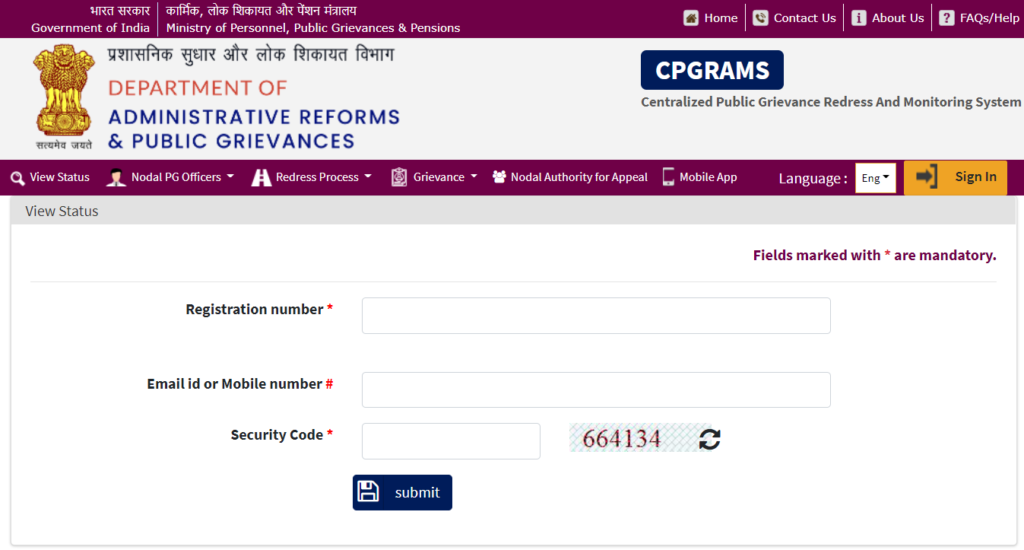

View Your Grievance Status

- You can directly go to the official website of the Department of Administrative Reforms and Public Grievances.

- The home page will open before you

- Now Select Grievance >> View Status as shown below

- New Page will open as shown below

- Now you have to enter your registration number, security code, and email ID or mobile number

- After that, you have to click on submit

- Grievance status will be shown on your computer screen.

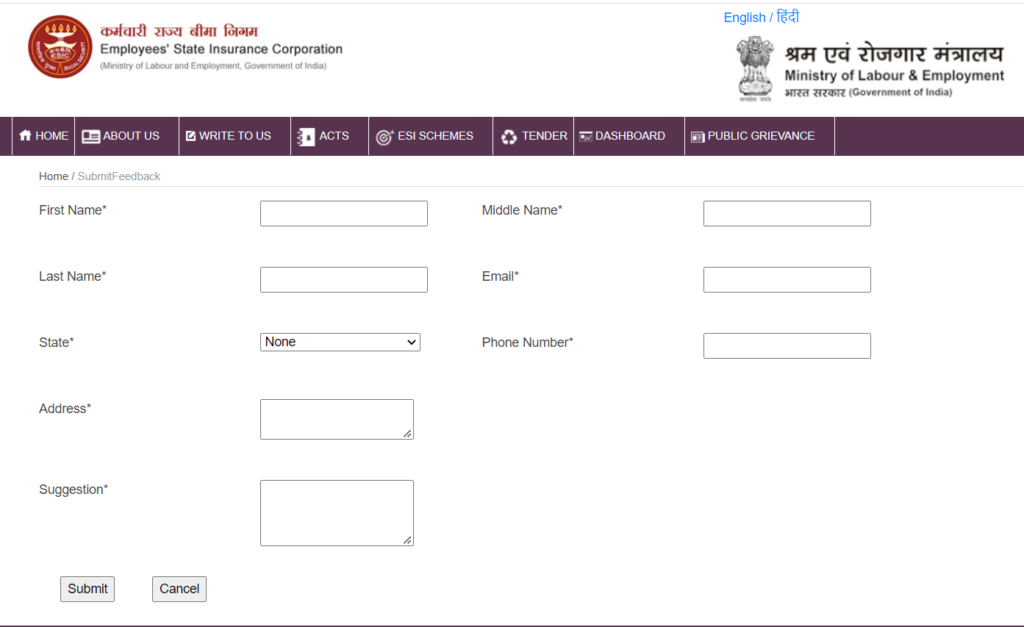

Give Feedback On the ESIC Services

- Visit the official website of Employees’ State Insurance Corporation

- The home page will open before you

- Now you have to click on Write to us > Feedback from the dropdown menu

- A feedback form will appear before you

- You have to enter your name, state, address, email id, phone number, etc on the form

- After that, you have to click on submit

- By following this procedure you can give feedback

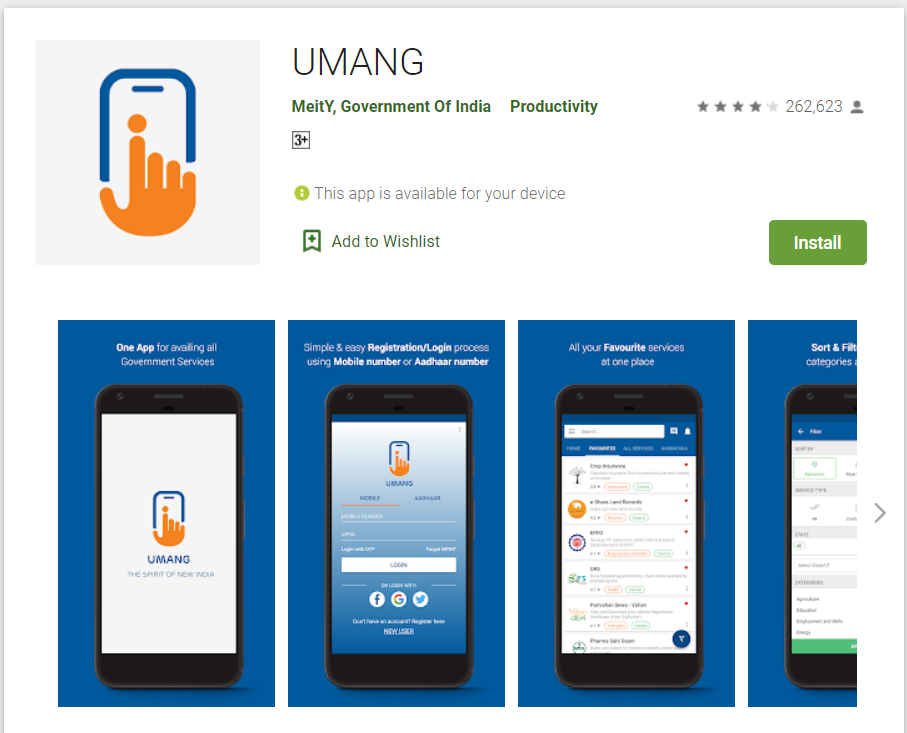

Procedure To Download Umang ESIC Mobile App

- First of all, go to the official website of Employees’ State Insurance Corporation

- The home page will open before you

- On the homepage, you should click on the Umang-ESIC mobile app (In the top right corner)

- You will be redirected to a new page

- On this page, you have to click on install

- By following this procedure Mobile app will download to your device.

Also Read – How To Apply For EWS certificate?

Contact Details

- For Information Technology (IT) related Issues/Queries:

- Mail – ITCare@esic.nic,in

- Phone – 011-27552237

- For Issues and Queries related to ‘Shram Suvidha’ portal:

- Mail – help-shramsuvidha@gov.in

- Phone – 011-23354722 (Between 2:00 PM to 5:00 PM)

- For other General Information/Queries:

- Phone – 1800112526

- Suggestions/Grievances:

- Mail to pg-hqrs@esic.nic.in

FAQs – ESIC Challan Online Payment

1. What is the difference between ESI and mediclaim?

ESI and medical insurance are different things. ESI is a statutory obligation of the employer whereas medical insurance is not. If the area where your organization is located is covered under ESI then your organization is bound to give ESI to its employees whose gross salary is less or equal to 15000.

2. Can we withdraw ESI amount?

ESI is a premium paid for medical benefits. If no benefit is obtained from it, there is no option available to withdraw the amount from ESI Account.

3. Can I continue ESI after leaving my job?

Even if you resign after contributing to ESIC for One day then also you are eligible for ESIC medical treatment until the end of the contribution period and again in the benefit period.

4. Is ESI compulsory?

ESI is mandatory for employers who have employees working in a non-seasonal factory with more than 10 employees, but only for employees who are earning less than ₹21,000 per paycheck.

Also Read: