Are you looking for your expected salary as per the 8th CPC? Well, you can calculate your salary with this 8th Pay Commission Salary Calculator. This will give you a clear picture of your estimated salary based on the 8th CPC notification.

8th Pay Commission Salary Calculator

Projected Salary Details (8th CPC)

| Component | Amount (₹) |

|---|

Also See - 8th Pay Commission Pension Calculator

8th Pay Commission Overview

The 8th Pay Commission is set to bring important salary changes for central government employees. As the 7th Pay Commission's tenure nears its completion, employees are eagerly awaiting updates on the 8th Pay Commission salary pay matrix, 8th CPC fitment factor, and potential salary hikes. In this article, we explore the latest news on the 8th pay commission, the expected salary structures, and how you can figure out your salary with the 8th CPC Salary Calculator.

The 8th Central Pay Commission (8th CPC) setup is approved by the Union Cabinet in January 2025 and is expected to be implemented in January 2026. This commission will determine the new salary structure for central government employees that aims to address inflation, rising living costs, and disparities in pay scales. With over 50 lakh employees and 65 lakh pensioners set to benefit from the 8th CPC.

Pay commissions are typically established every ten years to revise and update salaries, pensions, and other benefits. The 8th Pay Commission is expected to bring higher salary hikes, increased allowances, and improved benefits to government employees across the country.

Key Features of the 8th Pay Commission

1) Fitment Factor Revision

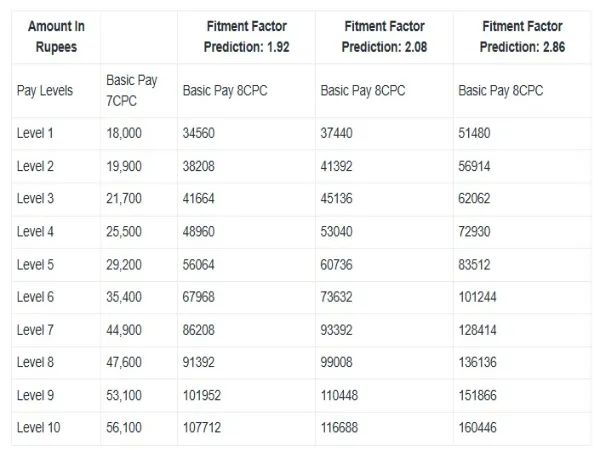

One of the key aspects of any pay commission is the fitment factor, which is used to calculate the revised salaries. The 7th Pay Commission fitment factor was 2.57, and for the 8th CPC, experts predict it may increase to 1.92 - 2.86. This means that the basic pay of employees will be multiplied by this factor to determine their new salaries. The 8th pay commission fitment factor is considered at 2.86 in all the calculations in this post.

Here is the list of previous fitment factors:

| Pay Commission | Fitment Factor | Salary Increase (%) |

|---|---|---|

| 6th Pay Commission | 1.86x | 20-30% |

| 7th Pay Commission | 2.57x | 14.3% |

| 8th Pay Commission (Expected) | 1.92 - 2.86x | 30-35% |

Impact of revised fitment factor: A minimum basic pay increase from ₹18,000 to ₹51,480 (186% hike).

Example:

Current Basic Pay (7th CPC): ₹18,000

Revised Basic Pay (8th CPC): ₹18,000 × 2.86 = ₹51,480

2) Dearness Allowance (DA) Adjustments

DA is expected to reset to 0% initially but is projected to reach 70% by 2026. This is based on the expected increases up to that point. Such a rise in DA will greatly affect the 8th CPC fitment factor and the pay of central government workers.

Formula: DA = Revised Basic Pay × DA Percentage.

| Year | Dearness Allowance (DA) Rate |

|---|---|

| 2023 | 54% |

| 2024 | 62% |

| 2025 | 66% |

| 2026 | 70% |

3) Revised Pay Matrix

The 8th pay commission salary pay matrix will align with revised pay levels and allowances. With the expected fitment factor of 2.86 under the 8th Pay Commission, the revised basic pay for across different levels of the Pay Matrix is anticipated to increase as follows:

| Pay Level | Current Basic Pay (7th CPC) | Expected Revised Basic Pay (8th CPC) | Increase (Approx) |

|---|---|---|---|

| Level 1 | ₹18,000 | ₹51,480 | ₹33,480 |

| Level 2 | ₹19,900 | ₹56,914 | ₹37,014 |

| Level 3 | ₹21,700 | ₹62,062 | ₹40,362 |

| Level 4 | ₹25,500 | ₹72,930 | ₹47,430 |

| Level 5 | ₹29,200 | ₹83,512 | ₹54,312 |

| Level 6 | ₹35,400 | ₹1,01,244 | ₹65,844 |

| Level 7 | ₹44,900 | ₹1,28,414 | ₹83,514 |

| Level 8 | ₹47,600 | ₹1,36,136 | ₹88,536 |

| Level 9 | ₹53,100 | ₹1,51,866 | ₹98,766 |

| Level 10 | ₹56,100 | ₹1,60,446 | ₹1,04,346 |

Level 1: Peons, Attendants, MTS (Multi-Tasking Staff) performing essential support tasks.

Level 2: Lower Division Clerks (LDCs) managing clerical and routine administrative duties.

Level 3: Constables and Skilled Trades Staff in police, defense, or public services.

Level 4: Stenographers (Grade D) and Junior Clerks managing transcription and documentation.

Level 5: Senior Clerks, Assistants, or Technical Staff providing higher-level administrative or technical support.

Level 6: Inspectors, Sub-Inspectors, and Junior Engineers (JEs) in technical or supervisory roles.

Level 7: Superintendents, Section Officers, or Assistant Engineers (AEs) handling project management or complex administrative tasks.

Level 8: Senior Section Officers or Assistant Audit Officers, managing audits or higher administrative functions.

Level 9: Deputy Superintendents of Police (DSPs) or Accounts Officers, responsible for operational or financial management.

Level 10: Group A Officers, such as Assistant Commissioners or entry-level officers in services like IAS, IPS, and IFS.

4) Pension Reforms

If the 8th CPC does have a 2.86 fitment factor, the minimum pension which is currently ₹9,000 will rise to nearly ₹25,740 per month, a jump of 186%.

Though predicting the hike is practically not feasible, based on the average pension hike percentages from previous pay commissions, the 8th Pay Commission may provide an average pension hike in the range of 20% to 30%. However, the actual percentage increase depends on various factors considered by the commission, including economic conditions and budgetary constraints.

How to Use the 8th CPC Salary Calculator

The 8th pay commission calculator simplifies salary projections using the below inputs:

- Current Pay Level: Select your current pay level from Level 1 to Level 18

- Current Basic Pay: Select your 7th CPC basic salary (e.g., ₹18,000).

- City Category: Select your city category for HRA calculation. (X=24%, Y=16% or Z=8%)

- DA Percentage: Projected at 70% by 2026. (adjustable based on official updates).

- Transport Allowance: Enter TA+DA based on your pay level and city (900+DA to 7200+DA)

- Fitment Factor: Default set to 2.86 (adjustable based on official updates).

- Deductions: Enter your deductions in medical, NPS and other contributions & taxes.

Example Calculation for Level 1 Employee:

- Current Basic Pay: ₹18,000

- New Basic Pay: ₹18,000 × 2.86 = ₹51,480

- DA (70%): ₹51,480 × 70% = ₹36,036

- HRA (24%): ₹51,480 × 24% = ₹12,355

- TA (₹3,600 – ₹7,200): ₹3600+DA = ₹6,120

- Total Salary: ₹51,480 + ₹36,036 + ₹12,355 + ₹6,120 = ₹1,05,991 (Gross Salary Excluding Dedutions)

(Note- This only projected value, the actual value may vary as per the final notification)

FAQs

Q1. When will the 8th Pay Commission be implemented?

The 8th Pay Commission is expected to be implemented by January 1, 2026.

Q2. What is the expected fitment factor for the 8th CPC?

The expected fitment factor is between 1.92 to 2.86

Q3. How much salary increase can I expect under the 8th Pay Commission?

Based on an estimated fitment factor of 2.86, salaries may increase by 30% to 35% the current basic pay.

Q4. How can I check my expected salary as per the 8th Pay Commission?

You can use this 8th Pay Commission Salary Calculator to estimate your salary hike as per 8th CPC.

Q5. How accurate is the 8th Pay Commission Salary Calculator?

The 8th Pay Commission Salary Calculator provides an estimated salary based on expected fitment factors, pay matrix revisions, and salary slabs. However, its accuracy depends on the official recommendations of the 8th CPC, which are yet to be finalized by the government.

Final Verdict

The 8th Pay Commission Salary Calculator gives a good estimate of potential salary hikes, but actual figures will depend on official notifications from the government. You should stay tuned with 8th CPC news for precise figures.

Also See - 8th CPC Pension Calculator